May 2025

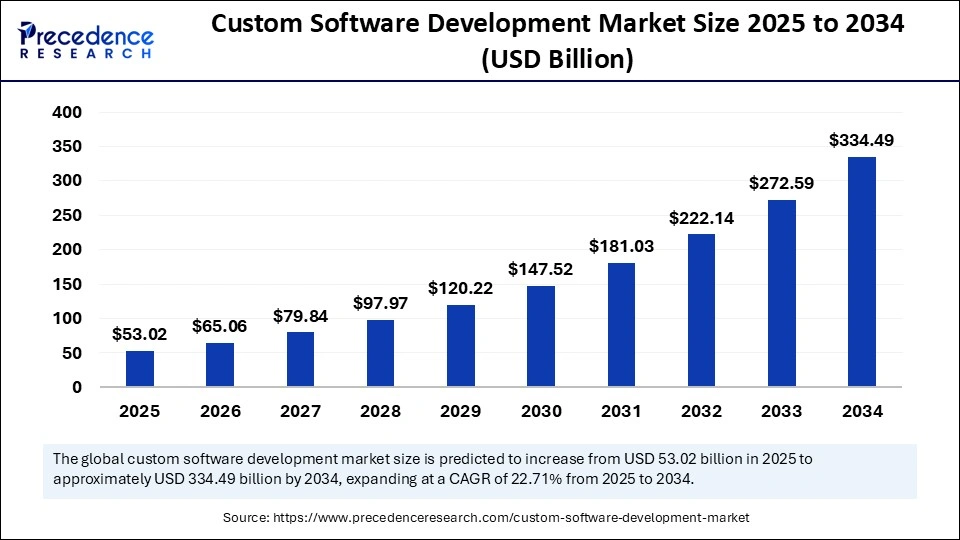

The global custom software development market size is calculated at USD 53.02 billion in 2025 and is forecasted to reach around USD 334.49 billion by 2034, accelerating at a CAGR of 22.71% from 2025 to 2034. The North America market size surpassed USD 14.69 billion in 2024 and is expanding at a CAGR of 22.89% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global custom software development market size accounted for USD 43.21 billion in 2024 and is predicted to increase from USD 53.02 billion in 2025 to approximately USD 334.49 billion by 2034, expanding at a CAGR of 22.71% from 2025 to 2034. The growth of the market is attributed to the increasing demand for tailored, scalable, and efficient solutions that meet specific business needs and drive digital transformation.

Artificial Intelligence is transforming the market for custom software development by improving code quality, speeding up development, and automating repetitive tasks. Artificial intelligence can evaluate large datasets using machine learning algorithms to forecast errors, optimize code, and even recommend enhancements. Additionally, AI tools help to expedite testing processes by increasing their speed and accuracy, which results in a shorter time to market. Furthermore, by examining user behavior patterns and modifying features appropriately, AI can customize software solutions to meet particular user needs, guaranteeing increased efficiency and personalization.

The U.S. custom software development market size was exhibited at USD 10.72 billion in 2024 and is projected to be worth around USD 84.82 billion by 2034, growing at a CAGR of 22.97% from 2025 to 2034.

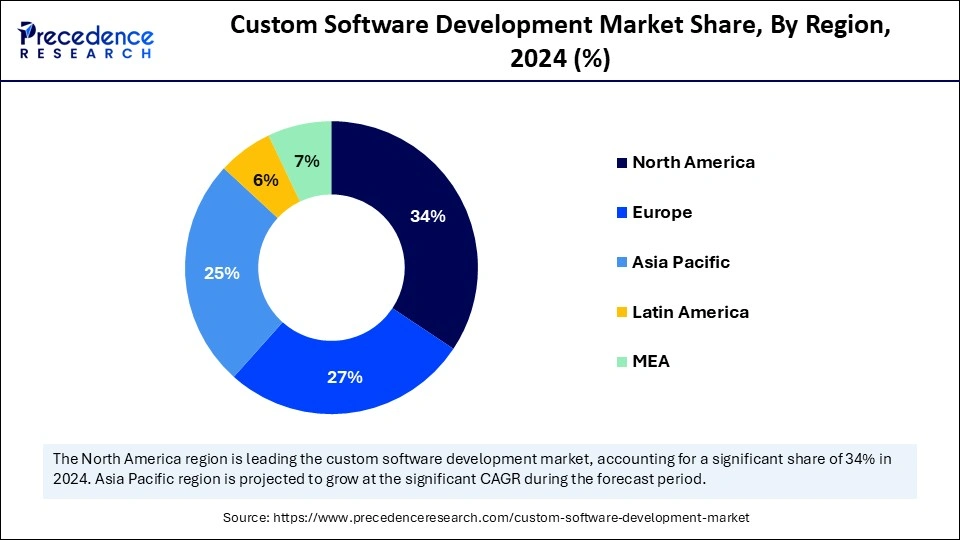

North America registered dominance market by capturing the largest share of 34% in 2024. This is mainly due to the widespread use of custom solutions among enterprises to meet specific requirements. The region has a robust digital infrastructure, facilitating seamless deployment of custom software. The region is home to some of the leading tech firms that are focusing on software development. Customized solutions are given top priority by local businesses to improve customer engagement and operational efficiency. Moreover, the well-established IT sector bolstered the growth of the market in the region.

Asia Pacific is poised to grow at the fastest CAGR of 25.32% in the upcoming years, driven by the rising need for scalable, affordable solutions and rapid digitization. The rapid expansion of the IT & telecom sector is supporting the market’s growth. A growing tech workforce and growing business needs are driving the adoption of custom software across a range of industries. With the rise of e-commerce, the need for custom software is increasing. In addition, the adoption of cloud computing is rising in the region, creating the need for cloud-based custom software.

Europe is considered to be a significantly growing area. The growth of the custom software development market in the region can be attributed to the presence of some of the well-known IT & telecom firms. There is a strong emphasis on industry-specific innovation, compliance, and data privacy. To comply with regulations and optimize operations, organizations in the region are actively looking for tailored solutions. The rapid digital transformation further supports regional market growth.

The custom software development market is expanding rapidly as a result of the growing need for individualized digital solutions across all industries. To meet particular operational requirements, increase customer engagement, and streamline workflows, organizations are moving toward customized applications. Technological developments in automation, artificial intelligence, machine learning, and low-code/no-code platforms, which allow for quicker and more economical development processes, further support this change. Custom software is also becoming more and more expensive for businesses to facilitate departmental digital transformation initiatives, remote work, and real-time analytics. Innovation is being spurred by these trends, which are also changing how businesses approach software solutions.

| Report Coverage | Details |

| Market Size by 2034 | USD 334.49 Billion |

| Market Size in 2025 | USD 53.02 Billion |

| Market Size in 2024 | USD 43.21 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 22.71% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Deployment Mode, Enterprise Size, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Investments in Custom Solutions

Startups and small-to-medium-sized businesses (SMEs) are investing heavily in custom software solutions to scale their businesses more effectively. To compete in the market and streamline workflows, SMEs need more adaptable and customized applications, whereas larger businesses frequently rely on off-the-shelf solutions. Through distinctive business models, streamlined procedures, and improved customer interaction, custom software enables them to set themselves apart. These companies require software that helps them streamline workflows. Custom solutions offer the scalability and adaptability needed to ensure long-term viability.

Focus on Enhanced Customer Experiences

Rising focus on enhancing customer experience drives the growth of the custom software development market. Providing outstanding customer service has become a top priority for businesses as they fight to remain competitive. Businesses can design individualized experiences that appeal to their clients by using custom software. Bespoke solutions allow companies to address particular customer pain points through customized product recommendations and distinctive user interfaces. Custom software enables businesses to collect and evaluate client data instantly, improving decision-making and service quality. By providing more than just standard services, offering customized and distinctive solutions that boost customer satisfaction not only encourages brand loyalty but also helps businesses stand out in crowded markets.

Complexity of Integration

It can be difficult and expensive to integrate custom software with legacy systems that are already in place. Because legacy systems frequently rely on antiquated technologies, integrating them with new custom software necessitates thorough planning, a great deal of testing, and perhaps even rewiring key procedures. Adopting custom solutions may be hampered by this integration process, which can also delay deployment, raise project costs overall, and cause technical problems that call for specialized knowledge.

Long Development Timeframes

From collecting requirements to testing and deployment, the process of developing custom software requires much time, which hampers the growth of the custom software development market. Each stage requires careful attention to detail and modifications based on feedback, and extended timelines. Businesses may find it difficult to react swiftly to shifting market conditions or technological breakthroughs due to the protracted development cycle. The slow pace of custom software development may be a drawback for businesses that require quick implementation or time to market.

Globalization and Remote Work Adoption

Businesses are expanding internationally, due to which they are shifting toward remote or hybrid work models, which create immense opportunities in the custom software development market. Businesses often require specialized digital tools for productivity, project management, and communication. The adaptability of off-the-shelf tools to suit particular team structures or workflows is frequently lacking. Businesses can build platforms that support remote teams that adhere to international compliance standards and adjust to multilingual or multi-time zone environments by using custom software development. Software that is remote-ready and scalable has a big chance because of this change.

The enterprise software segment dominated the custom software development market with the largest share of 61% in 2024 due to the increased demand from large enterprises. Large-scale businesses often require specialized solutions to improve data security, integrate legacy systems, and manage intricate workflows. These companies frequently need feature-rich rich scalable apps that can accommodate numerous users in various departments and locations. Businesses are still making significant investments in platforms that are specifically designed to meet their strategic objectives as the pace of digital transformation quickens.

The web-based solutions segment is growing at a remarkable CAGR of 21.2% during the predicted timeframe, driven by the rapid shift toward cloud computing and remote work models. Web-based solutions are very appealing to companies of all sizes because they provide cross-platform compatibility, real-time updates, and cost-effective deployment. Custom web-based software is becoming more and more popular among businesses due to the growing need for scalable, responsive, and easily maintainable applications.

The cloud segment dominated the custom software development market by holding more than 58% of the market share in 2024, driven by its cost-effectiveness, scalability, and adaptability. Because of their simpler deployment, automated updates, and lower infrastructure costs, businesses favor cloud-based solutions. The emergence of SaaS and hybrid cloud models has made cloud platforms the foundation of contemporary custom software development strategies.

The on-premises segment is representing a highest CAGR of 21.11% during the forecast period. The growth of the segment is attributed to the rising demand for on-premises solutions in various sectors where data control and regulatory compliance are essential. These solutions are widely preferred in the government, healthcare, and finance sectors. To comply with stringent data privacy regulations, businesses in these sectors are investing in safe, in-house hosted custom software. The growing concerns among businesses about data security and privacy are likely to support segmental growth.

The large enterprises segment accounted for the major market share of 61% in 2024. This is mainly due to the increased need to enhance customer experience. These enterprises often require custom software to meet specific requirements. To handle extensive workflows, ensure compliance, and streamline operations, these organizations frequently rely on customized integrated solutions. Their strong emphasis on automation and digital transformation drives steady investment in custom software systems.

The SEMs segment is projected to grow at the fastest rate in the upcoming period. The growth of the segment is attributed to the rising demand for scalable, flexible, and reasonably priced custom software solutions. SMEs can now afford customized solutions, thanks to the development of low-code platforms, cloud services, and modular development. Custom software is being used by SEMs more and more to increase customer engagement, optimize operations, and scale effectively. SMEs are looking to expand their operation worldwide, boosting the need for custom software.

The IT & telecom segment led the custom software development market with the biggest share of 22% in 2024. This is mainly due to the increased need for high-performance applications and automation in IT and telecom businesses. Custom solutions are essential to these businesses for network management, customer service enhancement, and real-time data processing. They can be major forces behind market expansion due to their requirement for scalable and agile platforms.

The government segment is growing at a fastest CAGR of 26% during the projection period, driven by efforts to digitize and the desire for effective public service delivery. In fields like digital ID systems, smart cities, and e-governance, custom solutions are being utilized more and more. As transparency, data security, and citizen-centric platforms gain more attention, governments are spending more on reliable custom software.

By Type

By Deployment Mode

By Enterprise Size

By Industry Vertical

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

May 2025

January 2025

June 2025