May 2025

The global healthcare contract development and manufacturing organization market size is estimated at USD 3.10 billion in 2025 and is predicted to reach around USD 4.63 billion by 2034, accelerating at a CAGR of 8.50% from 2025 to 2034. The North America healthcare contract development and manufacturing organization market size surpassed USD 103.83 billion in 2024 and is expanding at a CAGR of 8.52% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

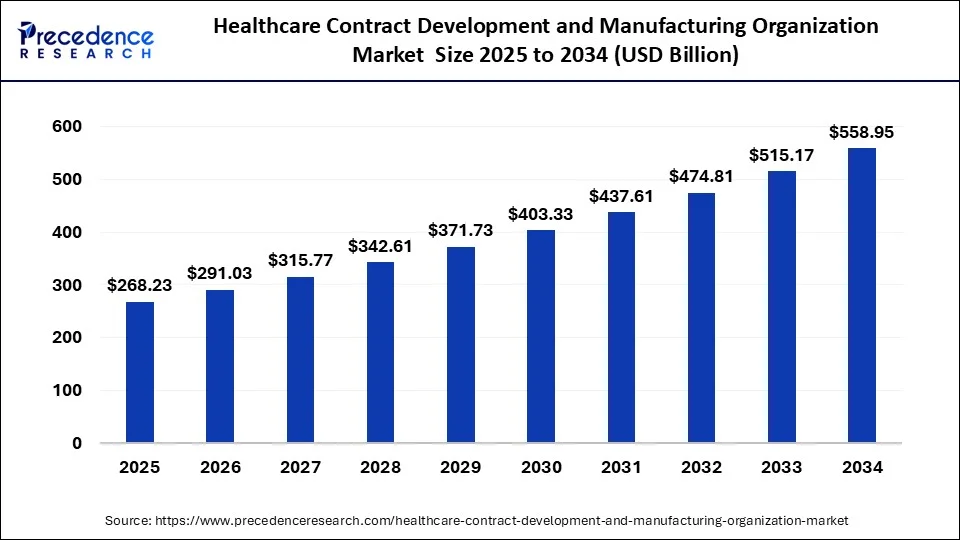

The global healthcare contract development and manufacturing organization market size was estimated at USD 247.22 billion in 2024 and is predicted to increase from USD 268.23 billion in 2025 to approximately USD 558.95 billion by 2034, expanding at a CAGR of 8.50% from 2025 to 2034.

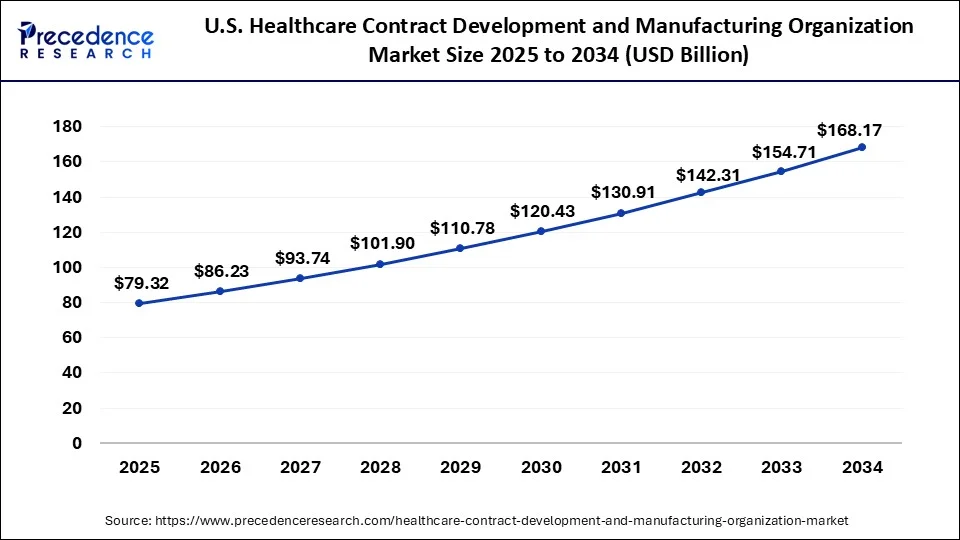

The U.S. healthcare contract development and manufacturing organization market size was estimated at USD 72.97 billion in 2024 and is predicted to be worth around USD 168.17 billion by 2034, at a CAGR of 8.70% from 2025 to 2034.

North America region accounted revenue share of 42% in 2024. The North America region’s demand for healthcare contract development and manufacturing was boosted by the growth of the pharmaceutical industry. As a result, in terms of contract development and manufacturing of medical devices, North America’s market is predicted to increase rapidly.

U.S. Healthcare Contract Development and Manufacturing Organization Market Trends:

U.S. is a major contributor to the market in North America. The growing demand for biologics, rising investments in R&D activities, increased collaborations and M&A activities among pharmaceutical companies, government support, booming generic drug market and rising incidences of chronic diseases are driving the market growth. Adoption of advanced technologies such as AI-powered analytics, single-use bioreactors and continuous manufacturing by CDMOs are enhancing production capacity, quality control and regulatory compliance.

Asia Pacific region is expected to develop at the fastest rate of 10% during the forecast period. The major changes to the European Union regulatory framework are anticipated, potentially affecting market access and entrance. Due to the Europe region’s severe regulatory laws, the market for healthcare contract development and manufacturing organization is likely to flourish.

Asia Pacific Healthcare Contract Development and Manufacturing Organization Market Trends:

Asia Pacific is anticipated to witness lucrative growth in the market over the forecast period. The market growth is driven by factors such as robust regulatory frameworks fostering innovation, need for compliance with quality standards to accelerate market reach, increased emphasis on development of complex drugs and medical devices, growing demand for biosimilars and availability of cost-effective skilled workforce.

Furthermore, government initiatives attracting foreign investments, rising trend of outsourcing drug development and manufacturing activities, and surging demand for pharmaceutical [products with increasing healthcare expenditure are fuelling the market expansion.

A contract development and manufacturing organization is a corporation or organization that provides classified services to other organizations on a contract basis, ranging from medication discovery to drug manufacture for a variety of therapeutic uses. These contract development and manufacturing organizations primarily function as an end user for small businesses that lack manufacturing capacity in the development of novel medications.

The healthcare contract development and manufacturing organizations are pharmaceutical industry institutions that provide a wide range of services on a contract basis, from medication development to drug manufacturing. This contract allows the bulk of pharmaceutical companies to outsource those aspects of their operations that can support scalability or allow the big company to focus on drug discovery and marketing instead. The formulation development, pre-formulation, clinical trials, formal stability, stability studies, registration, and commercial production batches are all services that pre-formulation provide. The goal of service providers is to focus on a single technology or dosage form while simultaneously ensuring end to end consistency and efficiency for all of their outsourcing customers.

The healthcare contract development and manufacturing organization market will be driven by the increased demand for specialist medical gadgets. A primary driver for the healthcare storage contract manufacturing industry in the growing population of older individuals and their inactive lifestyle. As a result, these variables will greatly boost the healthcare contract development and manufacturing organization market growth during the forecast period.

The disruption in the supply chain is one of the primary restraints in the healthcare contract development and manufacturing organization market. In addition, challenges with connectivity and standardization will slow industry expansion in the near future. Furthermore, the purchase of small businesses via contract with healthcare manufacturers will limit the component outsourcing.

However, because corporations are lining up for acquisitions and mergers, this approach will assist to down production costs. Additionally, the increased utilization of multi-product facilities, as well as many technological innovations and developments, will create new growth prospects for the healthcare contract development and manufacturing organization market during the forecast period.

The surge in desire to outsource various operations that are time demanding by the pharmaceutical companies is expected to boost the growth of the healthcare contract development and manufacturing organization market. The pharmaceutical industry’s rise will aid the healthcare contract development and manufacturing organization market’s expansion in the upcoming years. The increased support of contract development and manufacturing organizations in lowering the capital and operational expenses will assist the market in achieving maximum income in the near future.

The healthcare contract development and manufacturing organization market will be driven in the next years by a boom in regulatory affairs, which are positive, and quality assurance services. Furthermore, increasing shipping costs and the danger of violation of intellectual property rights could stifle the healthcare contract development and manufacturing organization market expansion throughout the projection period.

A company and a manufacturer sign a contract for contract manufacturing. For a specific period of time, the manufacturer provides the company with various components. The pharmaceutical and medical device components, as well as other services for drug manufacturing, are provided by contract manufacturers in the healthcare industry. The healthcare contract development and manufacturing organization market is being driven forward by the expiration of medical device patents and increased rivalry among large businesses. In addition, the healthcare contract development and manufacturing organization market is being boosted by the increased desire for convenient devices.

The major market players in the healthcare contract development and manufacturing organization market also offer customized services to fulfill the specific needs of medical device inventors and designers. Furthermore, the North America will continue to dominate the healthcare contract development and manufacturing organization market in the coming years. In addition, emerging countries in the Asia-Pacific region are thriving in the healthcare contract development and manufacturing organization market.

| Report Coverage | Details |

| Market Size in 2024 | USD 247.22 Billion |

| Market Size in 2025 | USD 3.10 billion |

| Market Size by 2034 | USD 558.95 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.50% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, and Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

In 2024, contract manufacturing dominated the market for healthcare contract development and manufacturing organization, accounting for the majority of revenue 74% in 2023. This is mostly wing to the pharmaceutical and medical device industries’ strong penetration of contract manufacturing.

On the other hand, the contract development is expected to grow at fastest rate during the forecast period. The contract development has various advantages over in-house drug development, including access to industry specialists, shorter time to market, lower costs, and a greater concentration on core skills.

The introduction of new products for outsourcing various processes in the pharmaceutical industry, as well as the expansion of key market competitors, are expected to drive the healthcare contract development and manufacturing organization market growth in the near future. The healthcare contract development and manufacturing organization market is expected to develop significantly in the forecast period due to the increase in acquisitions and definitive agreements made by the leading market leaders.

By Services

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

December 2024

February 2025

May 2025