May 2025

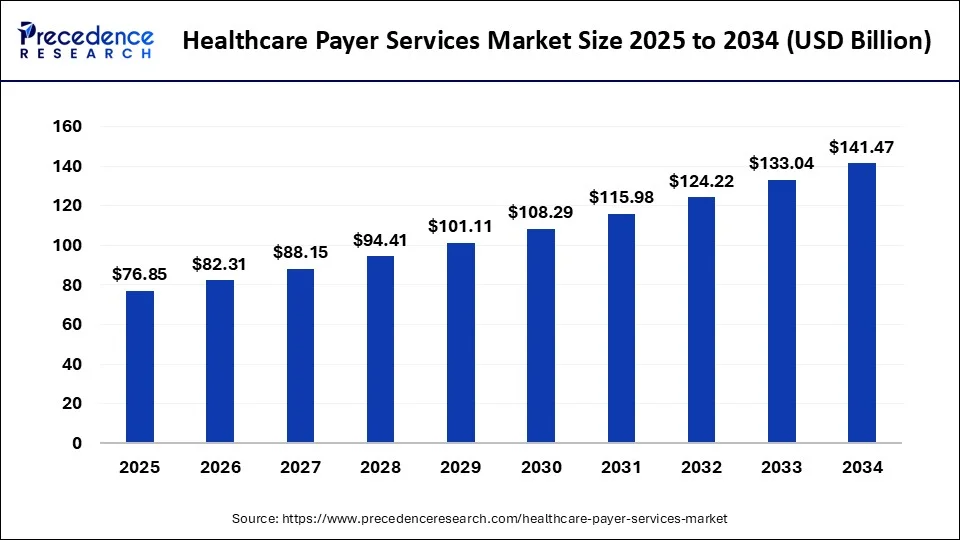

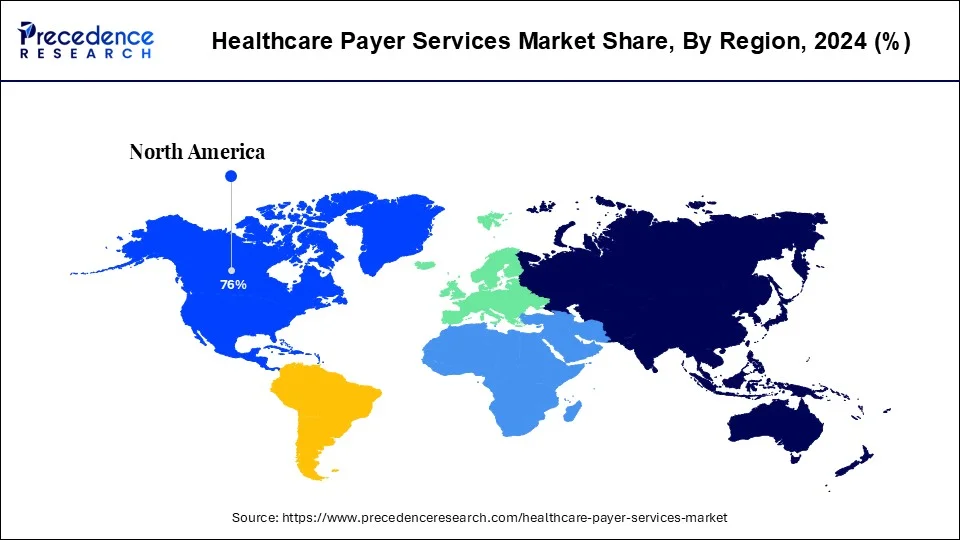

The global healthcare payer services market size is calculated at USD 76.85 billion in 2025 and is forecasted to reach around USD 141.47 billion by 2034, accelerating at a CAGR of 7.02% from 2025 to 2034. The North America healthcare payer services market size surpassed USD 54.54 billion in 2024 and is expanding at a CAGR of 7.09% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global healthcare payer services market size was estimated at USD 71.76 billion in 2024 and is predicted to increase from USD 76.85 billion in 2025 to approximately USD 141.47 billion by 2034, expanding at a CAGR of 7.02% from 2025 to 2034.

The U.S. healthcare payer services market size was estimated at USD 38.23 billion in 2024 and is expected to reach over USD 75.91 billion by 2034, expanding at a CAGR of 7.10% from 2025 to 2034.

The North America segment dominated the global healthcare payer services market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The U.S. accounted major market share in the North America region. This is due to a number of variables, including rising healthcare insurance membership and the presence of a favorable reimbursement regulatory frameworks.

The US Healthcare Payer Services Market is undergoing various significant trends that are transforming the sector. A significant trend is the growing use of digital health technologies. Payers are putting money into telehealth solutions and mobile health apps to boost accessibility and increase patient involvement. This change is motivated by the evolving desires of consumers who are looking for more convenient healthcare solutions. Furthermore, the incorporation of artificial intelligence. In the US, alterations in regulations and reforms in healthcare policy are essential in influencing the Healthcare Payer Services Market. The execution of the Affordable Care Act greatly increased insurance access, affecting millions of Americans. As stated by the U.S. Department of Health and Human Services, around 20 million individuals obtained health insurance coverage as a result of these reforms.

The Asia-Pacific is estimated to be the most opportunistic segment during the forecast period. India is one of the leading countries in the global knowledge process outsourcing services sector. Furthermore, China and Japan are significantly contributing to the global healthcare payer services market.

Healthcare payer services are services that healthcare insurance payers and providers contract out. Various outsourcing solutions are being used by healthcare insurance providers and payers to improve their business processes and give better service to their consumers. Outsourcing has emerged as a viable business strategy for reducing administrative, logistics, procurement, and other responsibilities while developing cost-effective business processes.

The healthcare payer services market is likely to be driven by rising insurance enrollments, an increase in healthcare fraud, and an increased usage of analytics in healthcare during the projected period. Some reasons, such as the increasing use of digital technologies in payer operations, increased consumer demand, and a rise in mergers and acquisitions, are expected to enhance the industry in the next years.

Furthermore, one of the key drivers projected to fuel the healthcare payer services market expansion over the forecast period is the increased engagement of a broader population, beyond front and back-end office operations, to drive the effectiveness and efficiency across corporate processes.

The growing demand for healthcare payer services can be linked to the growing requirement to run business processes more cost-effectively through the use of engagement and contract models. In addition, healthcare payer services improve patient care by streamlining the process and improving customer communication. The healthcare payer services are also useful in billing and account administration, analytics and fraud management, and human resource services and claims management.

Due to the growing number of healthcare payer service providers and the increasing demand to decrease costs, the healthcare payer services market is predicted to increase during the forecast period. When compared to in-house payer services, outsourcing healthcare payer services is less expensive. The number of clients is expanding, due to increasing technical advancements and increased acceptance of analytics in healthcare, as well as an increasing number of people opting for healthcare insurance. All these factors are likely to drive the growth of the healthcare payer services market during the forecast period.

However, issues such as the rising frequency of cyber theft that is the loss of personal data, and the hidden costs associated with outsourcing are projected to stifle the healthcare payer services market’s growth during the forecast period.

On the other hand, the developed information technology (IT) and healthcare infrastructure, as well as an expanding number of healthcare payer services providers, are likely to boost the healthcare payer services market’s expansion.

| Report Highlights | Details |

| Market Size by 2034 | USD 141.47 Billion |

| Market Size in 2025 | USD 76.85 Billion |

| Market Size in 2024 | USD 71.76 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.02% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The business process outsourcing services dominates the healthcare payer services market during the forecast period. The healthcare payer business process outsourcing (BPO) sector is expected to develop due to rising healthcare costs and a growing focus on reducing total administrative costs of member services and claim management services.

The knowledge process outsourcing services is expected to grow at rapid pace during the forecast period. This is attributed to the increased need for highly qualified workers, as well as the cost savings associated with outsourcing high-end procedures to emerging countries.

The analytics and fraud management services dominate the healthcare payer services market during the forecast period. The knowledge process outsourcing services cover a variety of important operations, including fraud monitoring analytics and risk management analytics data analysis.

The claims management services is expected to grow at rapid pace during the forecast period. One of the primary factors likely to fuel the healthcare payer services market is the increased demand for predictive modeling and claim analytics. This is driving the growth of the segment.

The private dominates the healthcare payer services market during the forecast period. Due to increased private investment in the healthcare payer vertical and growing government assistance to stimulate private investment in the healthcare industry, private payers accounted for largest market share.

The public is expected to grow at rapid pace during the forecast period. The growing healthcare expenditure, constantly falling out-of-pocket expenditure, and the expanding presence of global health insurance are some of the critical aspects projected to positively strengthen the growth of the segment.

Key Companies & Market Share Insights

The major market players are primarily focused on mergers and acquisitions in order to broaden their skills, diversify their company portfolios, and improve healthcare delivery outcomes. Furthermore, these mergers are projected to facilitate population health management by providing incentives that help to improve efficiency while moving toward a quality-driven system. In 2015, Aetna Inc. purchased Humana in order to move toward patient-centered, value-based healthcare.

By Service

By Application

By End User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

December 2024

February 2025

May 2025