May 2024

The global senolytics and anti-aging pharmaceuticals market size accounted for USD 4.50 billion in 2025 and is forecasted to hit around USD 8.72 billion by 2034, representing a CAGR of 7.63% from 2025 to 2034. The North America market size was estimated at USD 1.76 billion in 2024 and is expanding at a CAGR of 7.74% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global senolytics and anti-aging pharmaceuticals market size was estimated at USD 4.18 billion in 2024 and is predicted to increase from USD 4.50 billion in 2025 to approximately USD 8.72 billion by 2034, expanding at a CAGR of 7.63% from 2025 to 2034. The growth of the market is driven by the rising research activities aimed at understanding aging and senescence. Furthermore, the rising demand for solutions to avoid the degenerative processes of aging and associated chronic diseases drives the growth of the market.

Artificial Intelligence (AI) significantly changes the landscape of the market for senolytics and anti-aging pharmaceuticals. AI-based technology recognizes potential candidates for anti-aging medicine targeting senescent cells, which is a signal of aging. AI-driven solutions have the potential to find new senolytic agents. AI plays a significant role in developing and discovering senolytic anti-aging medicine. AI-driven medicine screening platforms analyze massive chemical libraries and identify compound toxicity and efficacy, potentially fast-tracking the detection of promising anti-aging therapies. Moreover, AI can analyze individual patient data, including genetic profiles, to develop personalized synolytic treatment plans.

The U.S. senolytics and anti-aging pharmaceuticals market size was evaluated at USD 1.32 billion in 2024 and is projected to be worth around USD 2.80 billion by 2034, growing at a CAGR of 7.80% from 2025 to 2034.

North America dominated the senolytics and anti-aging pharmaceuticals market by holding the largest share in 2024. This is mainly due to a significant increase in the aging population in the last few years. The region has well-established healthcare and research infrastructures that support the rapid development of senolytics and anti-aging therapies. The U.S. is a major contributor to the North American market. The country has a large cohort of geriatric people, leading to a high prevalence of age-related diseases. This, in turn, boosts the demand for senolytics and anti-aging therapies. In addition, increased awareness among people about the benefits of anti-aging therapies in extending healthspan bolstered the growth of the market.

Asia Pacific is anticipated to witness the fastest growth during the forecast period. The growth of the market in the region is driven by the growing aging population, especially in countries like China, India, and Japan. The rising healthcare spending significantly influences the market’s growth. The Chinese government is investing heavily in healthcare infrastructure and research and development activities to address the challenges of an aging population. China's medical sector is growing rapidly, creating immense opportunities in the market. In addition, major biotech companies in India are focusing on developing affordable anti-aging therapies. The increasing burden of age-related diseases, such as chronic disease, contributes to regional market growth.

Europe is a significantly growing area in the upcoming period. The growth of the senolytics and anti-aging pharmaceuticals market in Europe can be attributed to the increasing aging population and advancements in medical research. The rising number of clinical trials aimed at age-related diseases supports regional market growth. In addition, the increasing number of cases of age-related diseases drives market growth in the region.

The senolytics and anti-aging pharmaceuticals market is witnessing significant growth due to the rising need for medicines that improve the healthspan of individuals and mitigate the risk of age-related diseases, such as chronic diseases, aging syndromes, and degenerative diseases. Senescent cells accumulate with aging, leading to multiple diseases. These cells do not replicate, releasing factors that lead to tissue dysfunction. An increasing development of senolytic complexes that stimulate apoptosis in cancer cells with senescence, like dasatinib and quercetin, which manage clinical challenges in pulmonary fibrosis, aging, and after radiotherapy, supports market growth. The rising prevalence of age-related diseases significantly propels the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.72 Billion |

| Market Size in 2025 | USD 4.50 Billion |

| Market Size in 2024 | USD 4.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.63% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Distribution Channel, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing Aging Population

The growing aging population is a major factor driving the growth of the senolytics and anti-aging pharmaceuticals market. According to the WHO estimation, by 2030, 1 in 6 people in the world will be aged 60 years or over. As birth rates decline, the younger generation is becoming smaller relative to the expanding elderly population, raising the average age worldwide. This demographic shift increases the prevalence of age-related diseases, which significantly boosts the demand for interventions that can slow down aging and extend the health span. Advances in drug discovery and delivery systems are accelerating the development of senolytic therapies that can reduce the mortality rate associated with age-related diseases. With the increasing life expectancy, maintaining health and independence in later years has become a critical priority, leading to greater demand for products that support active and healthy aging.

High Costs

The high costs associated with developing and testing new selonytic drugs is a key factor limiting the growth of the senolytics and anti-aging pharmaceuticals market. Developing senolytic drugs requires significant investment in research and clinical trials, impacting production costs. Lengthy approval processes for drugs further create challenges in the market. In addition, the development of anti-aging pharmaceuticals faces several challenges, as aging is not currently recognized as a disease.

Nanotechnology Accelerates Innovation

Nanotechnology is revolutionizing the way signs of aging can be managed by allowing scientists to manipulate material at the molecular and atomic levels. A major application lies in targeted drug delivery, where engineered nanoparticles are designed to transport drugs, genes, or other therapeutic molecules directly to senescent cells or damaged tissue. This precision significantly enhances the treatment efficacy and minimizes side effects, providing transformative approaches to managing age-related conditions.

The anti-aging pharmaceuticals segment dominated the senolytics and anti-aging pharmaceuticals market with the largest share in 2024. This is mainly due to the heightened awareness of the aging process and the potential of anti-aging therapies to address age-related diseases. Consistent applications of anti-aging products decrease the appearance of fine lines and wrinkles, which are specific signs of aging. They manage the fundamental causes of aging and alleviate any age-related ailment, prolonging the health span.

The senolytic agents segment is expected to grow at the fastest rate in the coming years. The growth of the segment is attributed to the rising development of new senolytic drugs. They enhance vascular and cardiac function, improve insulin sensitivity, lower calcification of vessels, increase vessel sensitivity to neurotransmitters such as acetylcholine, and release different age and obesity-related symptoms. Senolytics reduce the amount of naturally occurring senescent human cells in vitro, enhance physical function, and improve the lifespan of patients.

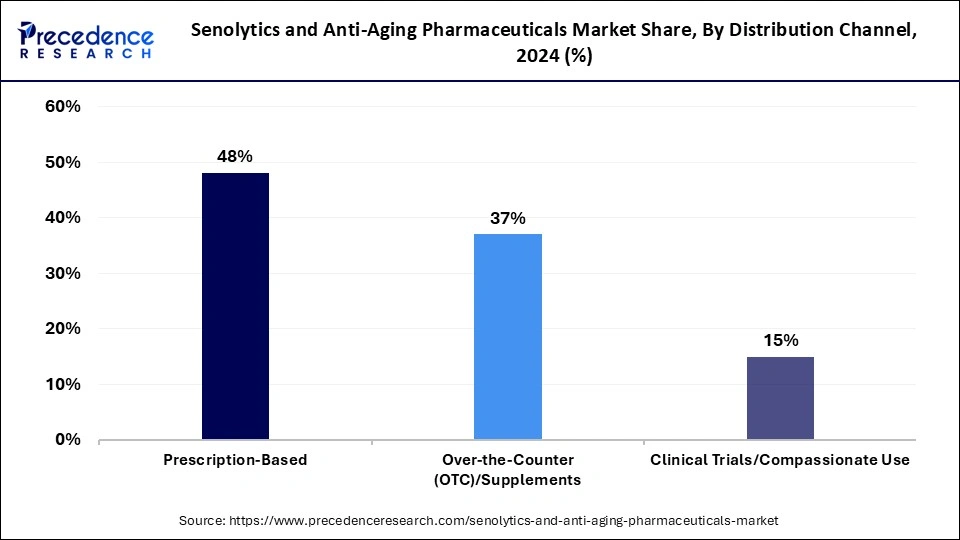

The prescription-based segment held the dominant share of the senolytics and anti-aging pharmaceuticals market in 2024. Prescription-based treatments increase access to required medications for patients, particularly those who might struggle to purchase them. This is significantly helpful for individuals with chronic conditions who need constant therapy. This allows for precise dosage control and the use of medications with greater potency and higher potential for interaction with other substances.

The over-the-counter (OTC)/supplements segment is likely to expand at the fastest rate during the forecast period. Supplements that are helpful in reducing aging signs are easily available over the counter, reducing the need to visit hospitals and thereby saving money. The increasing healthcare costs are a major factor boosting the demand for OTC products.

The clinical use/off-label therapeutics segment held the largest share of the senolytics and anti-aging pharmaceuticals market. Senolytics are proposed to decrease senescent cells, lower inflammation, and ease frailty in human beings. Senolytics lessen disease in several organs, develop physical resilience and function, and reverse all causes of mortality, even if administered to the aging person. The increased number of clinical trials target age-related diseases and extend healthspan bolstered the segment’s growth.

The consumer wellness/longevity use segment is anticipated to grow at a significant rate in the upcoming period. The growth of the segment can be attributed to the rising focus on improving overall health and wellness. Senolytics are an evolving class of drugs that have been found to support the restoration of the body, and this drug compound extends the lifespan and enhances the condition of general well-being. Senolytics is a novel type of drug created to target and eliminate senescent cells.

By Product

By Distribution Channel

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

July 2024

May 2025

May 2025